Merck & Co., Inc., Rahway, N.J., USA (NYSE: MRK), known as MSD outside the United States and Canada, today announced financial results for the fourth quarter and full year of 2025.

“In 2025, we continued to advance leading-edge science to deliver transformative medicines and vaccines that are improving health outcomes for patients around the world,” said Robert M. Davis, chairman and chief executive officer. “Our business benefited from demand for our innovative portfolio, including for KEYTRUDA, increasing contributions from new launches in cardiometabolic and respiratory as well as vaccines, and strong performance of Animal Health. The transformation of our portfolio, bolstered by the acquisitions of Verona Pharma and Cidara Therapeutics, is well underway, and momentum is building as we continue to execute on our strategy. Our progress positions us to continue delivering on our purpose for patients and creating durable value for shareholders.”

Financial Summary

|

$ in millions, except EPS amounts

|

Fourth Quarter

|

Year Ended

|

|

2025

|

2024

|

Change

|

Change Ex-Exchange

|

Dec. 31, 2025

|

Dec. 31, 2024

|

Change

|

Change Ex-Exchange

|

|

Sales

|

$16,400

|

$15,624

|

5%

|

4%

|

$65,011

|

$64,168

|

1%

|

2%

|

|

GAAP net income1

|

2,963

|

3,743

|

-21%

|

-20%

|

18,254

|

17,117

|

7%

|

9%

|

|

Non-GAAP net income that excludes certain items1,2*

|

5,088

|

4,372

|

16%

|

17%

|

22,513

|

19,444

|

16%

|

18%

|

|

GAAP EPS

|

1.19

|

1.48

|

-20%

|

-18%

|

7.28

|

6.74

|

8%

|

10%

|

|

Non-GAAP EPS that excludes certain items2*

|

2.04

|

1.72

|

19%

|

19%

|

8.98

|

7.65

|

17%

|

19%

|

|

*Refer to table on page 9.

|

Generally Accepted Accounting Principles (GAAP) earnings per share (EPS) assuming dilution was $1.19 for the fourth quarter and $7.28 for the full year of 2025. Non-GAAP EPS was $2.04 for the fourth quarter and $8.98 for the full year of 2025. GAAP and non-GAAP EPS in the fourth quarter of 2025 include a charge of $0.05 per share related to an agreement with Dr. Falk Pharma GmbH (Falk) pursuant to which the Company secured the sole global rights to MK-8690. GAAP and non-GAAP EPS in the fourth quarter of 2024 include a charge of $0.23 per share related to the execution of licensing agreements with LaNova Medicines Ltd. (acquired by Sino Pharmaceutical Limited) and Hansoh Pharma. GAAP and non-GAAP EPS for the full years of 2025 and 2024 include charges of $0.20 and $1.28 per share, respectively, related to certain licensing agreements and asset acquisitions.

Non-GAAP EPS excludes acquisition- and divestiture-related costs, costs related to restructuring programs, and income and losses from investments in equity securities. Non-GAAP EPS in 2025 also excludes a net tax benefit, which reflects a net benefit related to favorable audit reserve adjustments. Non-GAAP EPS in the fourth quarter and full year of 2024 also exclude a benefit due to a reduction in reserves for unrecognized income tax benefits resulting from the expiration of the statute of limitations for assessments related to certain federal tax return years.

Fourth-Quarter Sales Performance

The following table reflects sales of the Company’s top products and significant performance drivers.

|

|

Fourth Quarter

|

|

$ in millions

|

2025

|

2024

|

Change

|

Change Ex-Exchange

|

Commentary

|

|

Total Sales

|

$16,400

|

$15,624

|

5%

|

4%

|

|

|

Pharmaceutical

|

14,843

|

14,042

|

6%

|

4%

|

Increase primarily driven by growth in oncology as well as cardiometabolic and respiratory, partially offset by a decline in vaccines.

|

|

KEYTRUDA/ KEYTRUDA QLEX

|

8,372

|

7,836

|

7%

|

5%

|

Growth driven by strong global uptake in earlier-stage indications, including triple-negative breast cancer (TNBC), non-small cell lung cancer (NSCLC), renal cell carcinoma, cervical and head and neck cancers, as well as continued global demand in metastatic indications, including urothelial, gastric and endometrial cancers. Sales growth was partially offset by timing of purchases in the U.S. Sales of KEYTRUDA QLEX were $35 million.

|

|

GARDASIL/

GARDASIL 9

|

1,031

|

1,550

|

-34%

|

-35%

|

Decline primarily due to lower demand in China, as well as lower sales in Japan following the national catch-up immunization program, partially offset by higher sales in the U.S. and timing in certain international markets.

|

|

PROQUAD, M-M-R II and VARIVAX

|

619

|

594

|

4%

|

3%

|

Increase primarily reflects higher sales of PROQUAD, which largely resulted from both the replenishment of doses borrowed from the U.S. Centers for Disease Control and Prevention Pediatric Vaccine Stockpile and from higher demand in Europe, partially offset by lower demand for M-M-R II in certain international markets and lower demand for VARIVAX in the U.S.

|

|

JANUVIA/JANUMET

|

501

|

487

|

3%

|

3%

|

Growth driven by higher net pricing in the U.S., partially offset by lower demand in China as well as in most other international markets due to generic competition.

|

|

BRIDION

|

499

|

449

|

11%

|

11%

|

Growth primarily due to higher demand and net pricing in the U.S., partially offset by lower demand in several international markets due to ongoing generic competition.

|

|

WINREVAIR

|

467

|

200

|

133%

|

133%

|

Growth primarily reflects continued uptake in the U.S. and early launch uptake in certain international markets, partially offset by lower net pricing in the U.S. largely due to Medicare Part D redesign.

|

|

Lynparza*

|

389

|

365

|

7%

|

4%

|

Growth primarily due to higher demand in several international markets.

|

|

CAPVAXIVE

|

279

|

50

|

N/M

|

N/M

|

Growth largely due to continued uptake in the U.S.

|

|

PREVYMIS

|

275

|

215

|

28%

|

26%

|

Increase primarily due to higher demand in the U.S. as well as in most international markets, reflecting in part the launch of new indications.

|

|

Lenvima*

|

272

|

255

|

7%

|

6%

|

Increase due to higher sales in the U.S., primarily reflecting higher demand, partially offset by lower pricing.

|

|

WELIREG

|

220

|

160

|

37%

|

37%

|

Growth primarily due to higher demand in the U.S. and continued launch uptake in several international markets, partially offset by lower net pricing in the U.S.

|

|

OHTUVAYRE

|

178

|

–

|

–

|

–

|

Represents sales following the Company’s Oct. 7, 2025 acquisition of Verona Pharma plc (Verona Pharma).

|

|

Animal Health

|

1,505

|

1,397

|

8%

|

6%

|

Growth primarily due to higher demand of livestock products.

|

|

Livestock

|

987

|

889

|

11%

|

9%

|

Growth primarily driven by higher demand across all species, as well as improved supply and new product launches.

|

|

Companion Animal

|

518

|

508

|

2%

|

0%

|

Growth from new product launches was partially offset by lower demand for other products in portfolio, reflecting a reduction in veterinary visits. Sales of BRAVECTO line of products were $222 million and $209 million in current and prior-year quarters, respectively, which represents an increase of 6%, or 5% excluding impact of foreign exchange.

|

|

Other Revenues**

|

52

|

185

|

-71%

|

-15%

|

Decline primarily due to unfavorable impact of revenue-hedging activities and lower revenue from third-party manufacturing arrangements.

|

|

*Alliance revenue for this product represents the Company’s share of profits, which are product sales net of cost of sales and commercialization costs.

|

|

**Other revenues are comprised primarily of revenues from third-party manufacturing arrangements and miscellaneous corporate revenues, including revenue-hedging activities.

|

|

N/M – Not meaningful.

|

Full-Year Sales Performance

The following table reflects sales of the Company’s top products and significant performance drivers.

|

|

Year Ended

|

|

$ in millions

|

Dec. 31, 2025

|

Dec. 31, 2024

|

Change

|

Change Ex-Exchange

|

|

Total Sales

|

$65,011

|

$64,168

|

1%

|

2%

|

|

Pharmaceutical

|

58,142

|

57,400

|

1%

|

1%

|

|

KEYTRUDA/KEYTRUDA QLEX

|

31,680

|

29,482

|

7%

|

7%

|

|

GARDASIL/GARDASIL 9

|

5,233

|

8,583

|

-39%

|

-39%

|

|

JANUVIA/JANUMET

|

2,544

|

2,268

|

12%

|

13%

|

|

PROQUAD, M-M-R II and VARIVAX

|

2,451

|

2,485

|

-1%

|

-2%

|

|

BRIDION

|

1,841

|

1,764

|

4%

|

4%

|

|

Lynparza*

|

1,450

|

1,311

|

11%

|

10%

|

|

WINREVAIR

|

1,443

|

419

|

N/M

|

N/M

|

|

Lenvima*

|

1,053

|

1,010

|

4%

|

4%

|

|

PREVYMIS

|

978

|

785

|

25%

|

23%

|

|

VAXNEUVANCE

|

825

|

808

|

2%

|

1%

|

|

CAPVAXIVE

|

759

|

97

|

N/M

|

N/M

|

|

WELIREG

|

716

|

509

|

41%

|

41%

|

|

ROTATEQ

|

673

|

711

|

-5%

|

-5%

|

|

Reblozyl*

|

525

|

371

|

41%

|

41%

|

|

LAGEVRIO

|

380

|

964

|

-61%

|

-61%

|

|

Simponi**

|

–

|

543

|

-100%

|

-100%

|

|

Animal Health

|

6,354

|

5,877

|

8%

|

9%

|

|

Livestock

|

3,896

|

3,462

|

13%

|

14%

|

|

Companion Animal

|

2,458

|

2,415

|

2%

|

2%

|

|

Other Revenues***

|

515

|

891

|

-42%

|

-6%

|

|

*Alliance revenue for Lynparza and Lenvima represent the Company’s share of profits, which are product sales net of cost of sales and commercialization costs. Alliance revenue for Reblozyl represents royalties.

|

|

**Marketing rights in former territories of the Company reverted to Johnson & Johnson on Oct. 1, 2024.

|

|

***Other revenues are comprised primarily of revenues from third-party manufacturing arrangements and miscellaneous corporate revenues, including revenue-hedging activities.

|

|

N/M – Not meaningful.

|

In addition, Koselugo alliance revenue was $436 million for the full year of 2025 compared with $170 million for the full year of 2024. The increase was due to an amendment to the collaboration agreement with AstraZeneca in 2025, which discontinued the provisions whereby the Company shared revenue and costs with AstraZeneca, and revised the payment structure, resulting in the Company’s recognition of a $150 million upfront payment and $175 million of regulatory milestones.

Full-year 2025 Pharmaceutical sales were $58.1 billion, representing growth of 1% both nominally and excluding the impact of foreign exchange. Sales growth was primarily driven by higher sales in oncology, particularly KEYTRUDA and WELIREG, as well as increased alliance revenue from Koselugo (resulting from the amendment to the collaboration agreement noted above), Reblozyl and Lynparza. Also contributing to sales growth were higher sales in the cardiometabolic and respiratory franchise largely attributable to the ongoing launch of WINREVAIR, as well as the inclusion of OHTUVAYRE sales resulting from the acquisition of Verona Pharma, which closed on Oct. 7, 2025. Growth in the diabetes franchise, largely attributable to higher net pricing of JANUVIA in the U.S., also contributed to sales growth. Sales growth in 2025 was partially offset by lower sales in the vaccines franchise reflecting lower sales of GARDASIL/GARDASIL 9, which were offset in part by the ongoing launch of CAPVAXIVE and the U.S. launch of ENFLONSIA. Lower sales in the immunology franchise (due to the return of the marketing rights for Simponi and Remicade in former Company territories to Johnson & Johnson on Oct. 1, 2024) and lower sales in the virology franchise (largely attributable to LAGEVRIO) also offset Pharmaceutical sales growth in 2025.

Full-year 2025 Animal Health sales were $6.4 billion, representing growth of 8%, or 9% excluding the impact of foreign exchange. Sales growth was primarily driven by the performance of Livestock products across all species and new product launches in Companion Animal. Sales of the BRAVECTO line of products were $1.1 billion in 2025, representing growth of 1% both nominally and excluding the impact of foreign exchange.

Fourth-Quarter and Full-Year Expense and Related Information

The table below presents selected expense information.

|

$ in millions

|

GAAP

|

Acquisition-

and

Divestiture-

Related Costs3

|

Restructuring

Costs

|

(Income)

Loss From

Investments

in Equity

Securities

|

Non-

GAAP2

|

|

Fourth Quarter 2025

|

|

|

|

|

|

|

Cost of sales

|

$5,551

|

$1,054

|

$1,173

|

$-

|

$3,324

|

|

Selling, general and administrative

|

2,898

|

48

|

2

|

–

|

2,848

|

|

Research and development

|

3,886

|

5

|

(111)

|

–

|

3,992

|

|

Restructuring costs

|

213

|

–

|

213

|

–

|

–

|

|

Other (income) expense, net

|

432

|

–

|

–

|

206

|

226

|

|

|

|

|

|

|

|

|

Fourth Quarter 2024

|

|

|

|

|

|

|

Cost of sales

|

$3,828

|

$701

|

$121

|

$-

|

$3,006

|

|

Selling, general and administrative

|

2,864

|

29

|

16

|

–

|

2,819

|

|

Research and development

|

4,585

|

12

|

(1)

|

–

|

4,574

|

|

Restructuring costs

|

51

|

–

|

51

|

–

|

–

|

|

Other (income) expense, net

|

126

|

(31)

|

–

|

152

|

5

|

|

$ in millions

|

GAAP

|

Acquisition-

and

Divestiture-

Related Costs3

|

Restructuring

Costs

|

(Income)

Loss From

Investments

in Equity

Securities

|

Non-

GAAP2

|

|

Year Ended Dec. 31, 2025

|

|

|

|

|

|

|

Cost of sales

|

$16,382

|

$2,871

|

$1,484

|

$-

|

$12,027

|

|

Selling, general and administrative

|

10,733

|

120

|

3

|

–

|

10,610

|

|

Research and development

|

15,789

|

19

|

175

|

–

|

15,595

|

|

Restructuring costs

|

889

|

–

|

889

|

–

|

–

|

|

Other (income) expense, net

|

151

|

(3)

|

–

|

(306)

|

460

|

|

|

|

|

|

|

|

|

Year Ended Dec. 31, 2024

|

|

|

|

|

|

|

Cost of sales

|

$15,193

|

$2,409

|

$495

|

$-

|

$12,289

|

|

Selling, general and administrative

|

10,816

|

117

|

83

|

–

|

10,616

|

|

Research and development

|

17,938

|

72

|

1

|

–

|

17,865

|

|

Restructuring costs

|

309

|

–

|

309

|

–

|

–

|

|

Other (income) expense, net

|

(24)

|

(79)

|

–

|

45

|

10

|

GAAP Expense, EPS and Related Information

Gross margin was 66.2% for the fourth quarter of 2025 compared with 75.5% for the fourth quarter of 2024. Gross margin was 74.8% for the full year of 2025 compared with 76.3% for the full year of 2024. The gross margin decline in both periods was primarily due to the unfavorable impacts of higher restructuring costs (primarily related to the accelerated depreciation of manufacturing lines at two sites under the 2025 Restructuring Program), inventory write-offs and amortization of intangible assets, as well as the recognition of inventory fair value step-up related to the Verona Pharma acquisition, partially offset by the favorable impact of product mix.

Selling, general and administrative (SG&A) expenses were $2.9 billion in the fourth quarter of 2025, an increase of 1% compared with the fourth quarter of 2024. The increase was primarily due to higher administrative costs, partially offset by lower promotional costs. Full-year 2025 SG&A expenses were $10.7 billion, a decrease of 1% compared with the full year of 2024. The decrease was primarily due to lower restructuring and promotional costs, partially offset by increased administrative costs.

Research and development (R&D) expenses were $3.9 billion in the fourth quarter of 2025, a decrease of 15% compared with the fourth quarter of 2024. The decrease was primarily due to lower charges for business development activity and a reduction to estimated contractual termination costs associated with restructuring actions, partially offset by higher clinical development costs. R&D expenses were $15.8 billion for the full year of 2025, a decrease of 12% compared with the full year of 2024. The decrease was primarily due to lower charges for business development activity, partially offset by higher clinical development spending and higher restructuring costs.

Other (income) expense, net, was $432 million of expense in the fourth quarter of 2025 compared with $126 million of expense in the fourth quarter of 2024 primarily due to higher net interest expense, higher foreign exchange losses and increased net losses from investments in equity securities. Other (income) expense, net, was $151 million of expense in the full year of 2025 compared with $24 million of income in the full year of 2024. The unfavorable year-over-year change primarily reflects $170 million of income in 2024 related to the expansion of an existing development and commercialization agreement with Daiichi Sankyo, as well as higher net interest expense and higher foreign exchange losses in 2025, partially offset by higher net income from investments in equity securities in 2025.

The effective tax rate was 13.4% for the fourth quarter of 2025 and 13.3% for the full year of 2025.

GAAP EPS was $1.19 for the fourth quarter of 2025 compared with $1.48 for the fourth quarter of 2024. The decrease was primarily driven by higher restructuring costs and amortization of intangible assets, partially offset by favorability from lower charges for business development transactions, as well as operational strength in the business driven in part by the benefits of the previously announced multiyear optimization initiative. GAAP EPS was $7.28 for the full year of 2025 compared with $6.74 for the full year of 2024. The increase was primarily driven by favorability from lower charges for business development transactions and operational strength in the business, partially offset by higher restructuring costs and amortization of intangible assets.

Non-GAAP Expense, EPS and Related Information

Non-GAAP gross margin was 79.7% for the fourth quarter of 2025 compared with 80.8% for the fourth quarter of 2024. The decrease was primarily due to higher inventory write-offs, partially offset by the favorable impact of product mix. Non-GAAP gross margin was 81.5% for the full year of 2025 compared with 80.8% for the full year of 2024. The increase was primarily due to the favorable impact of product mix, partially offset by higher inventory write-offs.

Non-GAAP SG&A expenses were $2.8 billion in the fourth quarter of 2025, an increase of 1% compared with the fourth quarter of 2024. The increase was primarily due to higher administrative costs, partially offset by lower promotional costs. Non-GAAP SG&A expenses were $10.6 billion for the full year of 2025, flat compared with the full year of 2024 as lower promotional costs were largely offset by higher administrative costs.

Non-GAAP R&D expenses were $4.0 billion in the fourth quarter of 2025, a decrease of 13% compared with the fourth quarter of 2024. Non-GAAP R&D expenses were $15.6 billion for the full year of 2025, a decrease of 13% compared with the full year of 2024. The decrease in both periods was primarily due to lower charges for business development activity, partially offset by higher clinical development costs.

Non-GAAP other (income) expense, net, was $226 million of expense in the fourth quarter of 2025 compared with $5 million of expense in the fourth quarter of 2024 primarily due to higher net interest expense and higher foreign exchange losses. Non-GAAP other (income) expense, net, was $460 million of expense in the full year of 2025 compared with $10 million of expense in the full year of 2024. The unfavorable year-over-year change primarily reflects $170 million of income in 2024 related to the expansion of an existing development and commercialization agreement with Daiichi Sankyo, as well as higher net interest expense and higher foreign exchange losses in 2025.

The non-GAAP effective tax rate was 15.4% for the fourth quarter of 2025 and 14.4% for the full year of 2025.

Non-GAAP EPS was $2.04 for the fourth quarter of 2025 compared with $1.72 for the fourth quarter of 2024. Non-GAAP EPS was $8.98 for the full year of 2025 compared with $7.65 for the full year of 2024. The increase in both periods was primarily driven by favorability from lower charges for business development transactions, as well as operational strength in the business driven in part by the benefits of the previously announced multiyear optimization initiative.

A reconciliation of GAAP to non-GAAP net income and EPS is provided in the table that follows.

|

Fourth Quarter

|

Year Ended

|

|

$ in millions, except EPS amounts

|

2025

|

2024

|

Dec. 31, 2025

|

Dec. 31, 2024

|

|

EPS

|

|

|

|

|

|

GAAP EPS

|

$1.19

|

$1.48

|

$7.28

|

$6.74

|

|

Difference

|

0.85

|

0.24

|

1.70

|

0.91

|

|

Non-GAAP EPS that excludes items listed below2

|

$2.04

|

$1.72

|

$8.98

|

$7.65

|

|

|

|

|

|

|

|

Net Income

|

|

|

|

|

|

GAAP net income1

|

$2,963

|

$3,743

|

$18,254

|

$17,117

|

|

Difference

|

2,125

|

629

|

4,259

|

2,327

|

|

Non-GAAP net income that excludes items listed below1,2

|

$5,088

|

$4,372

|

$22,513

|

$19,444

|

|

|

|

|

|

|

|

Excluded Items:

|

|

|

|

|

|

Acquisition- and divestiture-related costs3

|

$1,107

|

$711

|

$3,007

|

$2,519

|

|

Restructuring costs

|

1,277

|

187

|

2,551

|

888

|

|

Loss (income) from investments in equity securities

|

206

|

152

|

(306)

|

45

|

|

Decrease to net income before taxes

|

2,590

|

1,050

|

5,252

|

3,452

|

|

Estimated income tax (benefit) expense4

|

(465)

|

(421)

|

(993)

|

(1,125)

|

|

Decrease to net income

|

$2,125

|

$629

|

$4,259

|

$2,327

|

Pipeline and Portfolio Highlights

In 2025, the Company announced positive late-stage trial results from 18 Phase 3 trials and began enrolling patients in 21 new Phase 3 studies evaluating multiple indications and therapeutic areas, with approximately 80 Phase 3 studies currently underway.

Throughout the fourth quarter, the Company made important progress to advance its broad, diverse pipeline, meeting significant regulatory and clinical milestones.

-

Oncology:

-

U.S. Food and Drug Administration (FDA) approved KEYTRUDA and KEYTRUDA QLEX, each in combination with Padcev, for the perioperative treatment of adult patients with muscle-invasive bladder cancer (MIBC) who are ineligible for cisplatin-based chemotherapy based on Phase 3 KEYNOTE-905 trial.

-

Approvals represent the first PD-1 inhibitor plus antibody-drug conjugate (ADC) regimens for this patient population.

-

FDA awarded a priority review voucher under the Commissioner’s National Priority Voucher (CNPV) pilot program for sac-TMT, an investigational anti-TROP2 ADC being developed in collaboration with Kelun-Biotech.

-

European Commission (EC) approved the subcutaneous route of administration and new pharmaceutical formulation of KEYTRUDA for use across all KEYTRUDA indications for adult patients in Europe.

-

FDA accepted two supplemental Biologics License Applications (sBLAs) for KEYTRUDA and KEYTRUDA QLEX, each with Trodelvy, for the first-line treatment of certain patients with PD-L1+ inoperable (unresectable) locally advanced or metastatic TNBC based on Phase 3 KEYNOTE-D19/ASCENT-04 trial.

-

FDA set Prescription Drug User Fee Act (PDUFA) dates in the second half of 2026 for these applications.

-

Announced positive topline results from Phase 3 KEYNOTE-B15 trial in patients with MIBC who are eligible for cisplatin-based chemotherapy showing KEYTRUDA plus Padcev significantly improved event-free survival (EFS), overall survival (OS) and pathologic complete response (pCR) rates versus neoadjuvant chemotherapy and surgery when given before and after surgery.

-

In collaboration with Moderna, Inc. (Moderna), announced median five-year follow-up data from Phase 2b KEYNOTE-942/mRNA-4157-P201 study for intismeran autogene, an investigational mRNA-based individualized neoantigen therapy, in combination with KEYTRUDA in patients with high-risk melanoma (stage III/IV) following complete resection.

-

Infectious Diseases:

-

Announced positive topline results from the Phase 3 trial of the investigational, once-daily, oral, two-drug, single-tablet regimen of doravirine/islatravir (DOR/ISL) for the treatment of adults with HIV-1 infection who had not previously received antiretroviral treatment (treatment-naïve).

-

Cardiometabolic and Respiratory:

-

Presented new data at the American Heart Association Scientific Sessions 2025, including results from the Phase 3 CORALreef Lipids and heterozygous familial hypercholesterolemia (HeFH) trials, demonstrating that enlicitide decanoate, an investigational, oral proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitor being evaluated for the treatment of adults with hypercholesterolemia, significantly reduced low-density lipoprotein cholesterol (LDL-C) with a safety profile comparable to placebo.

-

FDA awarded a priority review voucher under the CNPV pilot program for enlicitide decanoate.

-

In January 2026, EC approved an expanded indication for WINREVAIR, in combination with other pulmonary arterial hypertension (PAH) therapies, for the treatment of PAH (Group 1 pulmonary hypertension) in adult patients with World Health Organization (WHO) Functional Class II, III and IV based on Phase 3 ZENITH trial.

-

In February 2026, FDA accepted a new sBLA for WINREVAIR seeking approval to update the U.S. product label based on Phase 3 HYPERION trial.

-

FDA set PDUFA date of September 21, 2026.

-

Announced that Phase 2, proof-of-concept CADENCE study evaluating WINREVAIR in adults for the treatment of combined post- and precapillary pulmonary hypertension (CpcPH) due to heart failure with preserved ejection fraction (HFpEF) met its primary endpoint.

-

Business Development:

-

In 2026, completed acquisition of Cidara Therapeutics, Inc. (Cidara) for a total transaction value of approximately $9.2 billion.

-

Added MK-1406 (formerly CD388), an investigational long-acting, strain-agnostic antiviral agent designed to prevent influenza infection in individuals at higher risk of complications, to the Company’s portfolio.

-

MK-1406 is currently being evaluated in the Phase 3 ANCHOR study.

-

Entered into strategic financing agreement with Blackstone Life Sciences to partially fund the development of sac-TMT in 2026.

-

Entered into an agreement with Falk for certain development and commercialization rights to MK-8690, an investigational anti-CD30 ligand monoclonal antibody.

Notable recent news releases on the Company’s pipeline and portfolio are provided in the table that follows. Visit the News Releases section of the Company’s website to read the releases.*

|

Oncology

|

FDA Approved KEYTRUDA and KEYTRUDA QLEX, Each With Padcev, as Perioperative Treatment for Adults With Cisplatin-Ineligible MIBC; Based on Results From Phase 3 KEYNOTE-905 Trial

|

|

EC Approved Subcutaneous Administration of KEYTRUDA for All Adult Indications Approved in EU; Based on Results From Phase 3 3475A-D77 Trial

|

|

KEYTRUDA Plus Padcev Significantly Improved EFS, OS and pCR Rates for Cisplatin-Eligible Patients With MIBC When Given Before and After Surgery; Based on Results From Phase 3 KEYNOTE-B15 Trial

|

|

The Company and Moderna Announced 5-Year Data for Intismeran Autogene in Combination With KEYTRUDA Demonstrated Sustained Improvement in the Primary Endpoint of Recurrence-Free Survival in Patients With High-Risk Stage III/IV Melanoma Following Complete Resection; Based on Follow-up Analysis From Phase 2b KEYNOTE-942/mRNA-4157-P201 Trial

|

|

The Company Initiated Phase 3 KANDLELIT-007 Trial Evaluating Calderasib (MK-1084),

an Investigational Oral KRAS G12C Inhibitor, in Combination With KEYTRUDA QLEX in Certain Patients With Advanced NSCLC

|

|

The Company Presented Data at the American Society of Hematology Annual Meeting 2025 That Showcased Continued Advancements in Hematology Pipeline and Novel Therapeutic Approaches

|

|

Vaccines and Infectious Diseases

|

The Company Announced Positive Topline Results From Pivotal Phase 3 Trial Evaluating Investigational, Once-Daily, Oral, Two-Drug, Single-Tablet Regimen of DOR/ISL in Treatment-Naïve Adults With HIV-1 Infection

|

|

Cardiometabolic and Respiratory

|

Enlicitide Decanoate Significantly Reduced LDL-C in Phase 3 CORALreef Lipids Trial

|

|

Enlicitide Decanoate Significantly Reduced LDL-C in Adults With HeFH in Phase 3 CORALreef HeFH Trial

|

|

WINREVAIR Met Primary Endpoint in Phase 2, Proof-Of-Concept CADENCE Study in Adults With CpcPH Due to HFpEF

|

|

Neuroscience

|

The Company Showcased Data for Alzheimer’s Disease Candidates MK-2214 and MK-1167 at Clinical Trials on Alzheimer’s Disease 2025

|

|

Animal Health

|

FDA Conditionally Approved EXZOLT CATTLE-CA1 for Prevention and Treatment of New World Screwworm (Cochliomyia Hominivorax) Larvae (Myiasis)

|

|

*References to the Company’s name in the above news release titles have been modified for the purpose of this announcement.

|

U.S. Government Agreement

The Company reached an agreement with the U.S. government that is intended to lower medicine costs for Americans. This agreement enables the Company to continue its long-standing commitment to advancing breakthrough scientific discoveries for patients and helps ensure Americans can access the medicines they need at lower costs. The voluntary agreement addresses all four components of the President’s July letter.

Under the agreement, among other things, the Company plans to provide key products through a direct-to-patient program at affordable prices for eligible patients in the U.S. In addition, the Company reached an understanding with the U.S. Department of Commerce to delay Section 232 tariffs for three years, enabling the Company to make investments in the U.S. to reshore manufacturing for American patients. The Company has committed more than $70 billion in capital and R&D spending to strengthen U.S. production and innovation.

Full-Year 2026 Financial Outlook

The following table summarizes the Company’s full-year financial outlook.

|

|

Full Year 2026

|

|

Sales*

|

$65.5 billion to $67.0 billion

|

|

Non-GAAP Gross margin2

|

Approximately 82%

|

|

Non-GAAP Operating expenses2**

|

$35.9 billion to $36.9 billion

|

|

Non-GAAP Other (income) expense, net2

|

Approximately $1.3 billion expense

|

|

Non-GAAP Effective tax rate2

|

23.5% to 24.5%

|

|

Non-GAAP EPS2***

|

$5.00 to $5.15

|

|

Share count (assuming dilution)

|

Approximately 2.48 billion

|

|

*The Company does not have any non-GAAP adjustments to sales.

|

|

**Includes a one-time charge of approximately $9.0 billion associated with the acquisition of Cidara. Outlook does not assume any additional significant potential business development transactions.

|

|

***Includes a one-time charge of approximately $3.65 per share associated with the acquisition of Cidara.

|

The Company has not provided a reconciliation of forward-looking non-GAAP gross margin, non-GAAP operating expenses, non-GAAP other (income) expense, net, non-GAAP effective tax rate and non-GAAP EPS to the most directly comparable GAAP measures, given it cannot predict with reasonable certainty the amounts necessary for such a reconciliation, including intangible asset impairment charges, legal settlements, and income and losses from investments in equity securities either owned directly or through ownership interests in investment funds, without unreasonable effort. These items are inherently difficult to forecast and could have a significant impact on the Company’s future GAAP results.

The Company anticipates full-year 2026 sales to be between $65.5 billion and $67.0 billion, including a positive impact from foreign exchange of approximately 1% at mid-January 2026 exchange rates.

The Company’s full-year non-GAAP effective income tax rate is expected to be between 23.5% and 24.5% including the impact of the non-tax deductible one-time charge for the acquisition of Cidara.

The Company expects full-year 2026 non-GAAP EPS to be between $5.00 and $5.15, including a positive impact from foreign exchange of approximately $0.10 per share at mid-January 2026 exchange rates. This range includes a one-time charge of approximately $9.0 billion, or approximately $3.65 per share, as well as approximately $0.30 per share of related financing and operational costs, related to the acquisition of Cidara. In 2025, non-GAAP EPS of $8.98 was negatively impacted by one-time charges of $0.20 per share related to certain business development transactions.

Consistent with past practice, the financial outlook does not assume additional significant potential business development transactions.

Non-GAAP EPS excludes acquisition- and divestiture-related costs, costs related to restructuring programs, as well as income and losses from investments in equity securities.

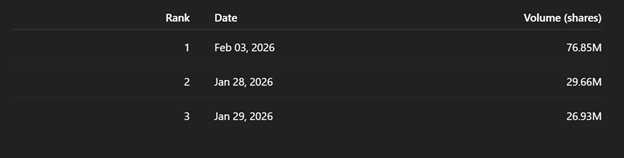

Earnings Conference Call

Investors, journalists and the general public may access a live audio webcast of the call on Tuesday, Feb. 3, at 9 a.m. ET via this weblink. A replay of the webcast, along with the sales and earnings news release, supplemental financial disclosures and slides highlighting the results, will be available on the Company’s website.

All participants may join the call by dialing (800) 369-3351 (U.S. and Canada Toll-Free) or (517) 308-9448 and using the access code 9818590.

About Our Company

At Merck & Co., Inc., Rahway, N.J., USA, known as MSD outside of the United States and Canada, we are unified around our purpose: We use the power of leading-edge science to save and improve lives around the world. For more than 130 years, we have brought hope to humanity through the development of important medicines and vaccines. We aspire to be the premier research-intensive biopharmaceutical company in the world – and today, we are at the forefront of research to deliver innovative health solutions that advance the prevention and treatment of diseases in people and animals. We foster a diverse and inclusive global workforce and operate responsibly every day to enable a safe, sustainable and healthy future for all people and communities.

Forward-Looking Statement of Merck & Co., Inc., Rahway, N.J., USA

This news release of Merck & Co., Inc., Rahway, N.J., USA (the “Company”) includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. There can be no guarantees with respect to pipeline candidates that the candidates will receive the necessary regulatory approvals or that they will prove to be commercially successful. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include but are not limited to, general industry conditions and competition; general economic factors, including interest rate and currency exchange rate fluctuations; the impact of pharmaceutical industry regulation and health care legislation in the United States and internationally; global trends toward health care cost containment; technological advances, new products and patents attained by competitors; challenges inherent in new product development, including obtaining regulatory approval; the Company’s ability to accurately predict future market conditions; manufacturing difficulties or delays; financial instability of international economies and sovereign risk; dependence on the effectiveness of the Company’s patents and other protections for innovative products; and the exposure to litigation, including patent litigation, and/or regulatory actions.

The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and the Company’s other filings with the Securities and Exchange Commission (SEC) available at the SEC’s Internet site (www.sec.gov).

Appendix

Generic product names are provided below.

Pharmaceutical

BRIDION (sugammadex)

CAPVAXIVE (Pneumococcal 21-valent Conjugate Vaccine)

ENFLONSIA (clesrovimab-cfor)

GARDASIL (Human Papillomavirus Quadrivalent [Types 6, 11, 16 and 18] Vaccine, Recombinant)

GARDASIL 9 (Human Papillomavirus 9-valent Vaccine, Recombinant)

JANUMET (sitagliptin and metformin HCl)

JANUVIA (sitagliptin)

KEYTRUDA (pembrolizumab)

KEYTRUDA QLEX (pembrolizumab and berahyaluronidase alfa-pmph)

LAGEVRIO (molnupiravir)

Lenvima (lenvatinib)

Lynparza (olaparib)

M-M-R II (Measles, Mumps and Rubella Virus Vaccine Live)

OHTUVAYRE (ensifentrine)

PREVYMIS (letermovir)

PROQUAD (Measles, Mumps, Rubella and Varicella Virus Vaccine Live)

Reblozyl (luspatercept-aamt)

ROTATEQ (Rotavirus Vaccine, Live, Oral, Pentavalent)

Simponi (golimumab)

VARIVAX (Varicella Virus Vaccine Live)

VAXNEUVANCE (Pneumococcal 15-valent Conjugate Vaccine)

WELIREG (belzutifan)

WINREVAIR (sotatercept-csrk)

Animal Health

BRAVECTO (fluralaner)

|

____________________

|

|

1 Net income attributable to the Company.

|

|

2 The Company is providing certain 2025 and 2024 non-GAAP information that excludes certain items because of the nature of these items and the impact they have on the analysis of underlying business performance and trends. Management believes that providing this information enhances investors’ understanding of the Company’s results because management uses non-GAAP results to assess performance. Management uses non-GAAP measures internally for planning and forecasting purposes and to measure the performance of the Company along with other metrics. In addition, annual employee compensation, including senior management’s compensation, is derived in part using a non-GAAP pretax income metric. This information should be considered in addition to, but not as a substitute for or superior to, information prepared in accordance with GAAP. For a description of the non-GAAP adjustments, see Table 2a attached to this release.

|

|

3 Reflects expenses related to business combinations, including the amortization of intangible assets, intangible asset impairment charges, and expense or income related to changes in the estimated fair value measurement of liabilities for contingent consideration. Also includes integration, transaction and certain other costs associated with acquisitions and divestitures, as well as amortization of intangible assets related to collaborations, licensing arrangements and asset acquisitions, and recognition of fair value step-up to inventories for asset acquisitions.

|

|

4 Includes the estimated tax impacts on the reconciling items based on applying the statutory rate of the originating territory of the non-GAAP adjustments for all periods presented. Amount in the full year of 2025 also includes a $60 million net benefit, which reflects a net benefit related to favorable audit reserve adjustments. Amounts in the fourth quarter and full year of 2024 also include a $260 million benefit and a $519 million benefit, respectively, due to reductions in reserves for unrecognized income tax benefits resulting from the expiration of the statute of limitations for assessments related to certain federal tax return years. The benefit recognized in the fourth quarter of 2024 relates to the 2020 federal tax return year and the benefit for the full year of 2024 relates to both the 2020 and 2019 federal tax return years.

|

| MERCK & CO., INC., RAHWAY, N.J., USA |

| CONSOLIDATED STATEMENT OF INCOME – GAAP |

| (AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES) |

| (UNAUDITED) |

| Table 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

% Change |

|

GAAP |

|

% Change |

|

|

|

|

|

|

|

|

4Q25

|

|

|

4Q24

|

|

|

|

Full Year 2025 |

Full Year 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$

|

16,400

|

|

$

|

15,624

|

|

|

5%

|

|

$

|

65,011

|

|

$

|

64,168

|

|

|

1%

|

|

|

|

|

|

|

|

|

|

|

|

| Costs, Expenses and Other |

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

5,551

|

|

|

3,828

|

|

|

45%

|

|

|

16,382

|

|

|

15,193

|

|

|

8%

|

| Selling, general and administrative |

|

|

2,898

|

|

|

2,864

|

|

|

1%

|

|

|

10,733

|

|

|

10,816

|

|

|

-1%

|

| Research and development |

|

|

3,886

|

|

|

4,585

|

|

|

-15%

|

|

|

15,789

|

|

|

17,938

|

|

|

-12%

|

| Restructuring costs |

|

|

213

|

|

|

51

|

|

|

* |

|

|

889

|

|

|

309

|

|

|

* |

| Other (income) expense, net |

|

|

432

|

|

|

126

|

|

|

* |

|

|

151

|

|

|

(24

|

)

|

|

* |

| Income Before Taxes |

|

|

3,420

|

|

|

4,170

|

|

|

-18%

|

|

|

21,067

|

|

|

19,936

|

|

|

6%

|

| Income Tax Provision |

|

|

458

|

|

|

425

|

|

|

|

|

|

2,804

|

|

|

2,803

|

|

|

|

| Net Income |

|

|

2,962

|

|

|

3,745

|

|

|

-21%

|

|

|

18,263

|

|

|

17,133

|

|

|

7%

|

| Less: Net (Loss) Income Attributable to Noncontrolling Interests |

|

|

(1

|

)

|

|

2

|

|

|

|

|

|

9

|

|

|

16

|

|

|

|

| Net Income Attributable to Merck & Co., Inc., Rahway, N.J., USA |

|

$

|

2,963

|

|

$

|

3,743

|

|

|

-21%

|

|

$

|

18,254

|

|

$

|

17,117

|

|

|

7%

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per Common Share Assuming Dilution |

|

$

|

1.19

|

|

$

|

1.48

|

|

|

-20%

|

|

$

|

7.28

|

|

$

|

6.74

|

|

|

8%

|

|

|

|

|

|

|

|

|

|

|

|

| Average Shares Outstanding Assuming Dilution |

|

|

2,488

|

|

|

2,537

|

|

|

|

|

|

2,507

|

|

|

2,541

|

|

|

|

| Tax Rate |

|

|

13.4

|

%

|

|

10.2

|

%

|

|

|

|

|

13.3

|

%

|

|

14.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * 100% or greater |

|

|

|

|

|

|

|

|

|

|

| MERCK & CO., INC., RAHWAY, N.J., USA |

| FOURTH QUARTER AND FULL YEAR 2025 GAAP TO NON-GAAP RECONCILIATION |

| (AMOUNTS IN MILLIONS, EXCEPT PER SHARE FIGURES) |

| (UNAUDITED) |

| Table 2a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP |

|

Acquisition- and Divestiture-Related Costs (1) |

|

Restructuring Costs (2) |

|

(Income) Loss from Investments in Equity Securities |

|

Certain Other Items |

|

Adjustment Subtotal |

|

Non-GAAP |

|

|

|

|

|

|

|

|

| Fourth Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

$

|

5,551

|

|

|

1,054

|

|

|

1,173

|

|

|

|

|

|

|

2,227

|

|

|

$

|

3,324

|

|

| Selling, general and administrative |

|

|

2,898

|

|

|

48

|

|

|

2

|

|

|

|

|

|

|

50

|

|

|

|

2,848

|

|

| Research and development |

|

|

3,886

|

|

|

5

|

|

|

(111

|

)

|

|

|

|

|

|

(106

|

)

|

|

|

3,992

|

|

| Restructuring costs |

|

|

213

|

|

|

|

|

213

|

|

|

|

|

|

|

213

|

|

|

|

–

|

|

| Other (income) expense, net |

|

|

432

|

|

|

|

|

|

|

206

|

|

|

|

|

206

|

|

|

|

226

|

|

| Income Before Taxes |

|

|

3,420

|

|

|

(1,107

|

)

|

|

(1,277

|

)

|

|

(206

|

)

|

|

|

|

(2,590

|

)

|

|

|

6,010

|

|

| Income Tax Provision (Benefit) |

|

|

458

|

|

|

(187

|

)

|

(3)

|

(234

|

)

|

(3)

|

(44

|

)

|

(3)

|

|

|

|

(465

|

)

|

|

|

923

|

|

| Net Income |

|

|

2,962

|

|

|

(920

|

)

|

|

(1,043

|

)

|

|

(162

|

)

|

|

|

|

(2,125

|

)

|

|

|

5,087

|

|

| Net Income Attributable to Merck & Co., Inc., Rahway, N.J., USA |

|

|

2,963

|

|

|

(920

|

)

|

|

(1,043

|

)

|

|

(162

|

)

|

|

|

|

(2,125

|

)

|

|

|

5,088

|

|

| Earnings per Common Share Assuming Dilution |

|

$

|

1.19

|

|

|

(0.37

|

)

|

|

(0.42

|

)

|

|

(0.06

|

)

|

|

|

|

(0.85

|

)

|

|

$

|

2.04

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax Rate |

|

|

13.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

15.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Full Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

$

|

16,382

|

|

|

2,871

|

|

|

1,484

|

|

|

|

|

|

|

4,355

|

|

|

$

|

12,027

|

|

| Selling, general and administrative |

|

|

10,733

|

|

|

120

|

|

|

3

|

|

|

|

|

|

|

123

|

|

|

|

10,610

|

|

| Research and development |

|

|

15,789

|

|

|

19

|

|

|

175

|

|

|

|

|

|

|

194

|

|

|

|

15,595

|

|

| Restructuring costs |

|

|

889

|

|

|

|

|

889

|

|

|

|

|

|

|

889

|

|

|

|

–

|

|

| Other (income) expense, net |

|

|

151

|

|

|

(3

|

)

|

|

|

|

(306

|

)

|

|

|

|

(309

|

)

|

|

|

460

|

|

| Income Before Taxes |

|

|

21,067

|

|

|

(3,007

|

)

|

|

(2,551

|

)

|

|

306

|

|

|

|

|

(5,252

|

)

|

|

|

26,319

|

|

| Income Tax Provision (Benefit) |

|

|

2,804

|

|

|

(525

|

)

|

(3)

|

(473

|

)

|

(3)

|

65

|

|

(3)

|

(60

|

)

|

(4)

|

(993

|

)

|

|

|

3,797

|

|

| Net Income |

|

|

18,263

|

|

|

(2,482

|

)

|

|

(2,078

|

)

|

|

241

|

|

|

60

|

|

|

(4,259

|

)

|

|

|

22,522

|

|

| Net Income Attributable to Merck & Co., Inc., Rahway, N.J., USA |

|

|

18,254

|

|

|

(2,482

|

)

|

|

(2,078

|

)

|

|

241

|

|

|

60

|

|

|

(4,259

|

)

|

|

|

22,513

|

|

| Earnings per Common Share Assuming Dilution |

|

$

|

7.28

|

|

|

(0.99

|

)

|

|

(0.83

|

)

|

|

0.10

|

|

|

0.02

|

|

|

(1.70

|

)

|

|

$

|

8.98

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax Rate |

|

|

13.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

14.4

|

%

|

| Only the line items that are affected by non-GAAP adjustments are shown. |

| The Company is providing certain non-GAAP information that excludes certain items because of the nature of these items and the impact they have on the analysis of underlying business performance and trends. Management believes that providing non-GAAP information enhances investors’ understanding of the Company’s results because management uses non-GAAP measures to assess performance. Management uses non-GAAP measures internally for planning and forecasting purposes and to measure the performance of the Company along with other metrics. In addition, annual employee compensation, including senior management’s compensation, is derived in part using a non-GAAP pretax income metric. The non-GAAP information presented should be considered in addition to, but not as a substitute for or superior to, information prepared in accordance with GAAP. |

| (1) Amounts included in cost of sales for the fourth quarter and full year reflect expenses for the amortization of intangible assets, as well as the recognition of fair value step-up of inventories related to the Verona Pharma acquisition. Cost of sales for the full year also includes intangible asset impairment charges. For the full year, cost of sales reflects a benefit from a decrease in the estimated fair value measurement of liabilities for contingent consideration. Amounts included in selling, general and administrative expenses reflect integration, transaction and certain other costs related to acquisitions and divestitures. Amounts included in research and development expenses reflect the amortization of intangible assets. |

| (2) Amounts primarily include employee separation costs, accelerated depreciation and asset impairment charges associated with facilities to be closed or divested, as well as contractual termination costs and related adjustments, associated with activities under the Company’s formal restructuring programs. |

| (3) Represents the estimated tax impacts on the reconciling items based on applying the statutory rate of the originating territory of the non-GAAP adjustments. |

| (4) Amount represents a net tax benefit, including a net benefit related to favorable audit reserve adjustments. |

| MERCK & CO., INC., RAHWAY, N.J., USA |

| FRANCHISE / KEY PRODUCT SALES |

| (AMOUNTS IN MILLIONS) |

| (UNAUDITED) |

| Table 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025

|

|

2024

|

|

4Q

|

|

Full Year

|

|

1Q |

2Q |

3Q |

4Q |

Full Year |

|

1Q |

2Q |

3Q |

4Q |

Full Year |

|

Nom % |

Ex-Exch % |

|

Nom % |

Ex-Exch % |

| TOTAL SALES (1) |

$15,529

|

$15,806

|

$17,276

|

$16,400

|

$65,011

|

|

$15,775

|

$16,112

|

$16,657

|

$15,624

|

$64,168

|

|

5

|

4

|

|

1

|

2

|

| PHARMACEUTICAL |

13,638

|

14,050

|

15,611

|

14,843

|

58,142

|

|

14,006

|

14,408

|

14,943

|

14,042

|

57,400

|

|

6

|

4

|

|

1

|

1

|

| Oncology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Keytruda |

7,205

|

7,956

|

8,142

|

8,337

|

31,641

|

|

6,947

|

7,270

|

7,429

|

7,836

|

29,482

|

|

6

|

5

|

|

7

|

7

|

| Keytruda Qlex |

|

|

5

|

35

|

40

|

|

|

|

|

|

|

|

–

|

–

|

|

–

|

–

|

| Alliance Revenue – Lynparza (2) |

312

|

370

|

379

|

389

|

1,450

|

|

292

|

317

|

337

|

365

|

1,311

|

|

7

|

4

|

|

11

|

10

|

| Alliance Revenue – Lenvima (2) |

258

|

265

|

258

|

272

|

1,053

|

|

255

|

249

|

251

|

255

|

1,010

|

|

7

|

6

|

|

4

|

4

|

| Welireg |

137

|

162

|

196

|

220

|

716

|

|

85

|

126

|

139

|

160

|

509

|

|

37

|

37

|

|

41

|

41

|

| Alliance Revenue – Reblozyl (3) |

119

|

107

|

136

|

164

|

525

|

|

71

|

90

|

100

|

110

|

371

|

|

48

|

48

|

|

41

|

41

|

| Vaccines (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gardasil/Gardasil 9 |

1,327

|

1,126

|

1,749

|

1,031

|

5,233

|

|

2,249

|

2,478

|

2,306

|

1,550

|

8,583

|

|

-34

|

-35

|

|

-39

|

-39

|

| ProQuad/M-M-R II/Varivax |

539

|

609

|

684

|

619

|

2,451

|

|

570

|

617

|

703

|

594

|

2,485

|

|

4

|

3

|

|

-1

|

-2

|

| Vaxneuvance |

230

|

229

|

226

|

140

|

825

|

|

219

|

189

|

239

|

161

|

808

|

|

-13

|

-16

|

|

2

|

1

|

| Capvaxive |

107

|

129

|

244

|

279

|

759

|

|

|

|

47

|

50

|

97

|

|

* |

* |

|

* |

* |

| RotaTeq |

228

|

121

|

204

|

119

|

673

|

|

216

|

163

|

193

|

139

|

711

|

|

-14

|

-15

|

|

-5

|

-5

|

| Pneumovax 23 |

41

|

38

|

45

|

42

|

166

|

|

61

|

59

|

68

|

74

|

263

|

|

-43

|

-44

|

|

-37

|

-37

|

| Hospital Acute Care |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bridion |

441

|

461

|

439

|

499

|

1,841

|

|

440

|

455

|

420

|

449

|

1,764

|

|

11

|

11

|

|

4

|

4

|

| Prevymis |

208

|

228

|

266

|

275

|

978

|

|

174

|

188

|

208

|

215

|

785

|

|

28

|

26

|

|

25

|

23

|

| Zerbaxa |

70

|

74

|

81

|

87

|

312

|

|

56

|

62

|

64

|

70

|

252

|

|

24

|

23

|

|

24

|

24

|

| Dificid |

83

|

96

|

43

|

25

|

247

|

|

73

|

92

|

96

|

79

|

340

|

|

-68

|

-68

|

|

-27

|

-27

|

| Cardiometabolic & Respiratory |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Winrevair |

280

|

336

|

360

|

467

|

1,443

|

|

|

70

|

149

|

200

|

419

|

|

133

|

133

|

|

* |

* |

| Alliance Revenue – Adempas/Verquvo (5) |

106

|

123

|

112

|

129

|

470

|

|

98

|

106

|

102

|

109

|

415

|

|

18

|

18

|

|

13

|

13

|

| Adempas (6) |

68

|

80

|

82

|

83

|

312

|

|

70

|

72

|

72

|

73

|

287

|

|

14

|

9

|

|

9

|

6

|

| Ohtuvayre |

|

|

|

178

|

178

|

|

|

|

|

|

|

|

–

|

–

|

|

–

|

–

|

| Virology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lagevrio |

102

|

83

|

138

|

57

|

380

|

|

350

|

110

|

383

|

121

|

964

|

|

-53

|

-53

|

|

-61

|

-61

|

| Isentress/Isentress HD |

90

|

86

|

82

|

67

|

325

|

|

111

|

89

|

102

|

92

|

394

|

|

-27

|

-28

|

|

-18

|

-18

|

| Delstrigo |

67

|

83

|

77

|

79

|

306

|

|

56

|

60

|

65

|

69

|

249

|

|

15

|

9

|

|

23

|

20

|

| Pifeltro |

45

|

41

|

43

|

42

|

171

|

|

42

|

39

|

42

|

40

|

163

|

|

6

|

4

|

|

5

|

4

|

| Neuroscience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Belsomra |

50

|

40

|

47

|

49

|

186

|

|

46

|

53

|

78

|

45

|

222

|

|

8

|

9

|

|

-16

|

-16

|

| Immunology |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Simponi |

|

|

|

|

|

|

184

|

172

|

189

|

|

543

|

|

|

|

|

-100

|

-100

|

| Remicade |

|

|

|

|

|

|

39

|

35

|

41

|

|

114

|

|

|

|

|

-100

|

-100

|

| Diabetes (7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Januvia |

549

|

372

|

382

|

302

|

1,604

|

|

419

|

405

|

278

|

232

|

1,334

|

|

30

|

30

|

|

20

|

21

|

| Janumet |

247

|

251

|

243

|

199

|

940

|

|

251

|

224

|

204

|

255

|

935

|

|

-22

|

-22

|

|

1

|

2

|

| Other Pharmaceutical (8) |

729

|

584

|

948

|

658

|

2,917

|

|

632

|

618

|

638

|

699

|

2,590

|

|

-6

|

-5

|

|

13

|

13

|

| ANIMAL HEALTH |

1,588

|

1,646

|

1,615

|

1,505

|

6,354

|

|

1,511

|

1,482

|

1,487

|

1,397

|

5,877

|

|

8

|

6

|

|

8

|

9

|

| Livestock |

924

|

961

|

1,023

|

987

|

3,896

|

|

850

|

837

|

886

|

889

|

3,462

|

|

11

|

9

|

|

13

|

14

|

| Companion Animal |

664

|

685

|

592

|

518

|

2,458

|

|

661

|

645

|

601

|

508

|

2,415

|

|

2

|

0

|

|

2

|

2

|

| Other Revenues (9) |

303

|

110

|

50

|

52

|

515

|

|

258

|

222

|

227

|

185

|

891

|

|

-71

|

-15

|

|

-42

|

-6

|

| *200% or greater |

|

|

|

|

|

|

|

|

|

|

|

| Sum of quarterly amounts may not equal year-to-date amounts due to rounding. |

|

|

|

|

|

|

|

|

|

| (1) Only select products are shown. |

| (2) Alliance Revenue represents the Company’s share of profits, which are product sales net of cost of sales and commercialization costs. |

| (3) Alliance Revenue represents royalties. |

| (4) Total Vaccines sales were $2,607 million, $2,370 million, $3,370 million and $2,364 million in the first, second, third and fourth quarter of 2025, respectively, and $3,424 million, $3,656 million, $3,675 million and $2,693 million in the first, second, third and fourth quarter of 2024, respectively. |

| (5) Alliance Revenue represents the Company’s share of profits from sales in Bayer’s marketing territories, which are product sales net of cost of sales and commercialization costs. |

| (6) Net product sales in the Company’s marketing territories. |

| (7) Total Diabetes sales were $876 million, $704 million, $703 million and $579 million in the first, second, third and fourth quarter of 2025, respectively, and $745 million, $715 million, $592 million and $546 million in the first, second, third and fourth quarter of 2024, respectively. |

| (8) Includes Pharmaceutical products not individually shown above. Also reflects total alliance revenue for Koselugo of $44 million, $43 million, $214 million and $135 million in the first, second, third and fourth quarter of 2025, respectively, and $38 million, $37 million, $39 million and $56 million in the first, second, third and fourth quarter of 2024, respectively. |

| (9) Other Revenues are comprised primarily of revenues from third-party manufacturing arrangements and miscellaneous corporate revenues, including revenue-hedging activities. Other Revenues related to the receipt of upfront and milestone payments for out-licensed products were $95 million, $5 million, $11 million and $27 million in the first, second, third and fourth quarter of 2025, respectively, and $61 million, $15 million, $15 million and $15 million in the first, second, third and fourth quarter of 2024, respectively. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20260203933145/en/

![]()